How to Start a Single Member LLC - A Full Guide

Starting a Single Member LLC: Your Comprehensive Guide

Starting a limited liability company (LLC) is foundational to you starting a business, winning grants, and securing the financial future of you and your family.

In this blog post, I’ll explain step by step how to set up a single-member LLC. I'll cover everything from understanding what an LLC is to filling out the required paperwork.

By the end of this post, you'll know how to:

Choose a name for your LLC

Decide where to set up your LLC

Register your LLC with the government

Get any needed licenses

Set up a bank account for your business

Handle ongoing paperwork

My goal is to help you start your LLC with confidence. This isn't just about starting a business - it's about creating new opportunities for you and your family.

What is a Single Member LLC?

A single-member LLC (Limited Liability Company) is a business structure that offers a unique blend of flexibility and protection. It’s perfect for entrepreneurs who want to run their business solo but need the legal safeguards that come with more formal entities like corporations. Essentially, it combines the ease of operating as a sole proprietor with the legal advantages of an LLC.

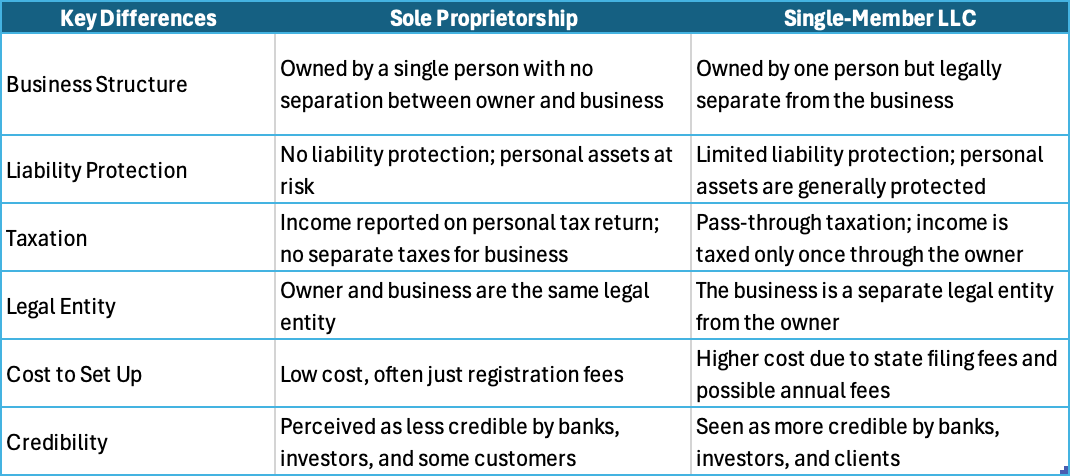

So, why choose a single-member LLC over just sticking with a sole proprietorship? The key benefit lies in the legal separation between you (the owner) and the business itself. With a sole proprietorship, your personal and business assets are legally tied together. If something goes wrong in the business—say, a lawsuit or financial trouble—you’re personally on the hook. Your savings, home, or other personal assets could be at risk.

However, with a single-member LLC, this dynamic changes. Your business becomes a separate legal entity. This means that your personal assets (such as your home, car, and bank accounts) are typically protected from business liabilities. In the event of a lawsuit or bankruptcy, only the assets owned by the LLC are vulnerable, shielding your personal finances.

Another great feature of a single-member LLC is the simplicity in taxes. You can opt for "pass-through" taxation, meaning that your business income is treated just like personal income. You won’t face the double taxation that corporations do. However, you still benefit from the formal structure that can make your business appear more credible to banks, investors, and clients.

In short, a single-member LLC gives you the best of both worlds: the simplicity of managing your own business while enjoying peace of mind knowing your personal assets are safeguarded. Check out the chart below for a breakdown of key differences.

Key Steps to Set Up a Single Member LLC

Creating a single-member LLC is a straightforward process when you have the support of a business formation company to walk you step by step through the process. By following these steps, you'll be on your way to establishing your single-member LLC and enjoying the benefits it provides. Let's dive in:

1. Choose a Unique Name

The first step in setting up a single-member LLC is selecting a unique name for your business. Make sure the name is not already in use by another entity in your state, meets the legal requirements set by your state, is not already trademarked (do a name search on the USPTO website), and is available across all social media platforms. Once you've settled on a unique and compliant name, it's time to move forward with the next step: choosing the state in which you'll form your LLC.

2. Choose Your State of Formation

Choosing the right state to form your single member LLC is crucial because it can significantly impact the legal and financial aspects of your business. Each state has its own set of regulations, tax structures, and levels of personal asset protection. For most small business owners, it’s best to form the LLC in the state where you live and conduct your business.

However, if your business operates across multiple states or you have specific legal or privacy concerns, you might benefit from forming your LLC in a state with more favorable laws like Wyoming. It’s essential to consider these factors carefully to ensure that your LLC provides the intended benefits and aligns with your business goals.

Additionally, when choosing your state of formation, it's important to think about privacy. The business address you use for your LLC will be public record, which could potentially compromise your privacy if you use your home address. To avoid this, consider setting up a virtual office. This provides you with a professional business address while keeping your personal information protected and separate from your business dealings

4. Choose A Registered Agent

Selecting a registered agent is an essential step in forming your LLC. A registered agent is a designated person or business entity responsible for receiving legal documents, such as tax notices or lawsuits, on behalf of your LLC. They must have a physical address in the state where your LLC is formed and be available during normal business hours. This ensures your business stays compliant with state regulations and doesn't miss any important notifications. For business owners who value privacy, a registered agent can help keep personal addresses off public records.

A business formation service like Tailor Brands can act as your registered agent, managing legal paperwork and ensuring you never miss critical documents. This allows you to focus on running your business while staying compliant and maintaining your privacy.

5. Register Your Single Member LLC

Furthermore, once you've settled on a name and chosen your state—keeping privacy considerations in mind—the next step is to file your Articles of Organization with the Secretary of State. This process can be complex and time-consuming, but companies like Tailor Brands can help simplify it.

They specialize in assisting new business owners by filing the required paperwork with the state on your behalf and handling the administrative details. Tailor Brands has helped over 300,000 business owners legitimize their businesses by setting up their business entities with their respective states, taking the hassle out of forming your LLC.

6. Create an Operating Agreement

An operating agreement is very important for your single-member LLC. This document outlines the ownership structure, management responsibilities, and key operational rules of your business. In addition, it helps establish clarity and avoid potential disputes in the future.

Here are the key details an operating agreement should include:

Ownership Structure: Clearly define that you are the sole owner of the LLC and outline any potential for adding new members in the future.

Management Responsibilities: Detail how the business will be managed, including your role as the sole member and how decisions will be made (whether you will manage it yourself or appoint a manager).

Profit and Loss Allocation: Specify how profits and losses will be distributed, even if all earnings go directly to you as the sole member.

Bank Accounts and Financial Procedures: Outline how business finances will be handled, including opening bank accounts, maintaining financial records, and paying expenses.

Business Operations: Provide guidelines on day-to-day operations, decision-making processes, and how key business activities will be conducted.

Asset Protection: Reinforce the separation between your personal and business assets to protect your personal liability in case of legal issues or business debts.

Dissolution Procedures: Outline what happens if you decide to dissolve the business, including how remaining assets will be distributed and debts settled.

Amendments to the Agreement: Specify how changes or updates to the operating agreement will be handled in the future.

Succession Planning: Include provisions for what happens to the LLC if you are no longer able to manage it, whether due to death, disability, or other reasons.

By having a detailed operating agreement, you create clarity and protection for both you and your business.

7. Obtain an EIN (Employer Identification Number)

An EIN, also known as a Federal Tax Identification Number, is a unique identifier for your business. It is required if you plan to hire employees, open business bank accounts, or file certain federal tax returns. You can easily apply for an EIN for free with the Internal Revenue Service (IRS) online.

8. Obtain Licenses and Permits

After forming your LLC, it's essential to ensure that your business complies with all legal requirements by obtaining the necessary licenses and permits. The type of licenses and permits you need will vary based on your industry, location, and the services you provide. For example, a food business may require health department permits, while a construction business may need specific contractor licenses.

At the federal level, certain businesses may need to apply for licenses from agencies like the Environmental Protection Agency (EPA) or the Alcohol and Tobacco Tax and Trade Bureau (TTB). You should also check with your state and local government to identify any additional permits required for your business to operate legally. For detailed information, you can visit the Small Business Administration.

Navigating these requirements can be overwhelming, but Tailor Brands can help by guiding you through the process of identifying and applying for the right licenses and permits. By ensuring you have the proper approvals in place, you can avoid costly penalties and keep your business running smoothly.

9. Set Up a Separate Business Bank Account

To keep your personal and business finances separate and maintain your limited liability protection, it's very important that you open a business bank account. Choose a bank or credit union that offers online business banking services and integrates with third-party apps, like Quickbooks, Shopify, and Etsy.

Remember to bring your LLC formation documents, EIN, and any other required documentation when opening a business bank account. Having this account makes it easier to track income and expenses, manage cash flow, and pay taxes.

9. Comply with Ongoing Requirements

Once your single-member LLC is established, it's important to stay compliant with ongoing requirements. This may include filing annual reports, paying state fees, and fulfilling any applicable tax obligations. Stay informed about the specific ongoing requirements in your state to avoid any penalties or legal complications.

In addition, starting in 2024, the Corporate Transparency Act will require most LLCs, including single-member LLCs, to submit a Beneficial Ownership Information (BOI) report to the Financial Crimes Enforcement Network (FinCEN). This report discloses the names of individuals who have significant ownership or control over the business.

Staying informed about these ongoing state and federal requirements is essential to avoid penalties or legal complications. By remaining compliant, you'll ensure that your LLC remains in good standing and continues to provide the legal protections you established it for.

By following these key steps, you will have successfully set up your single-member LLC and paved the way for a legally protected and thriving business. Remember, seeking professional guidance from an attorney or business formation company can provide valuable insights and ensure that you navigate the process smoothly.

Conclusion

Congratulations on completing my full guide on creating a single-member LLC! By following the steps outlined and understanding the benefits, you are well on your way to establishing a robust business entity.

Forming a single-member LLC can provide numerous advantages, such as separating your personal and business assets, gaining limited liability protection, and enjoying flexibility in taxes. These benefits can significantly contribute to the long-term success of your business.

Remember, as a business owner in the United States, it's crucial to have a solid legal foundation. The single-member LLC structure offers a straightforward and effective approach to achieving this. With the right approach and diligence in fulfilling the requirements, you can pave the way for a profitable business.